Bankrupt COCOBOD Abruptly Sacks Officers

…As Cocoa Farmers Pension Scheme Initiative Crumbles

The Ghana Cocoa Board (COCOBOD) has, in the wake of Ghana successfully securing a bailout from the International Monetary Fund (IMF), relieved some of its officers of their job, in an apparent move to downsize its staff strength.

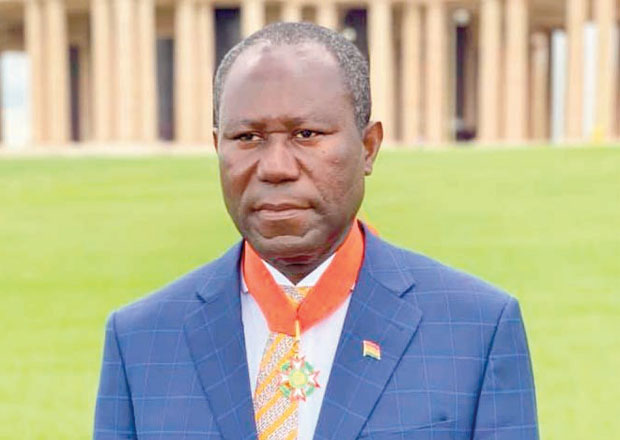

COCOBOD, led by its Chief Executive Officer (CEO), Joseph Boahen Aidoo, is said to be facing some challenges with funding in recent days, a development which is affecting some of its programmes.

The affected officers, who are enumerators with degrees and HND holders, working under the Cocoa Management System (CMS), will effective June 1, 2023 cease to work with the board.

Though information concerning this matter is sketchy, The Anchor has gathered that the enumerators, who were engaged a while ago, would have had their contract ending on June 30, 2023, with a likelihood of extension.

They were recruited by COCOBOD to register cocoa farmers across the country, where the crop is widely grown, purposely for a cocoa farmers pension scheme initiative.

A termination of contract letter dated, May 17, 2023 and sighted by The Anchor addressed to all enumerators through the national coordinator, Cocoa Management Systems, stated, “Management wishes to inform all Enumerators under the Cocoa Management System (CMS) to take note that their contract ends on 1 June 2023 instead of 30th June 2023.”

The letter, signed by the Director, Human Resource, Francis Gyamfi Ocran, and copied the Deputy Chief Executive (F&A Operation), National Coordination, CMS, added, “By a copy of this letter, the Director, Finance is requested to cease payment of their salaries effective 1 June 2023. We count on our co-operation.”

This means that these enumerators who could have had their contract extended are on their way home and to join hundreds of teeming unemployed youth.

COCOBOD, in March this year, started the rolling out of the Cocoa Farmers Pension Scheme with a target of enrolling some 800,000 cocoa farmers to benefit from the scheme.

It came on the back of some impressive strides, after piloting the scheme for three weeks in August 2021 at New Edubiase and some other districts in the Ashanti Region.

Farmers from 15 communities, out of the 70 cocoa districts across the country, were captured by the Cocoa Management System to start the initial phase of the scheme.

Some of the lucky communities to start this laudable programme were Tepa, Bekwai, Antoakrom, New Edubiase, Nyinahin, Judson and Obuosi.

Section 27 of the COCOBOD Law 1984 (PNDC Law 81) enjoins the Board of Directors to implement a contributory insurance and welfare scheme that provides a decent pension for cocoa farmers.

With this, it is unclear if these officers were able to register all these farmers in the 70 cocoa districts before this termination of contract.

Default On Payments

This termination of contract is coming after COCOBOD for the first time defaulted on payments of its matured 182-day bill, rolling over outstanding securities of GH₵940.4 million, albeit without investors prior notice.

Recall that the development in January, this year, led to confusion and concern for investors expecting payments to be made on these securities.

According to market information, the outstanding payments were made to investors who were credited, but later had it reversed and automatically rolled over without their permission.

The sudden default payments raised many questions among investors, as they now have to decide whether to sell their securities to willing investors or seek legal redress.

The situation, which had occurred as a result of government domestic debt restructuring programme, left many investors frustrated and disappointed, and feeling uncertain about their investments.

The Cocoa Bill was introduced in 2022 as additional options to the public who wanted to invest and a means of easing the cyclical pressure on the cedi, which was in its worst state. It had been a mainstay of the domestic capital market-particularly the 182-day variant.

They have recorded successful sale on account of the strength of its underlying asset, being the ever-important commodity, cocoa.

Source: Anchorghana.com