Partner Gov’t To Tackle Gold Smuggling – Minister Urges MIIF

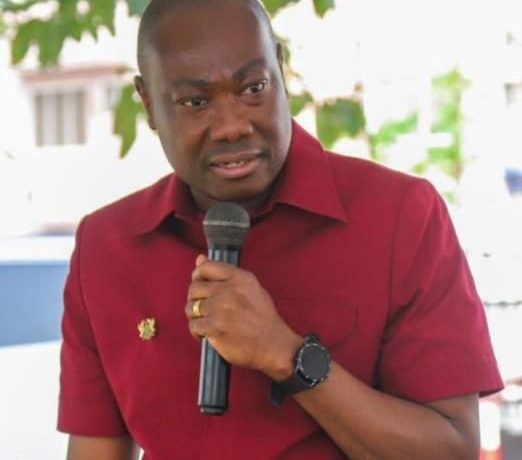

The Deputy Minister for the Lands and Natural Resources, George Mireku Duker, has tasked management of Minerals Income Investment Fund (MIIF) to partner National Security Ministry, Lands, as well as Finance Ministries to develop a strong system to track and halt gold smuggling.

Mr Duker, who was a former Board Chairman of MIIF, wants the Fund, to collaborate effectively with other institutions to curb issues of illicit funding of mineral projects in Ghana.

He indicated that, the trend where a chunk of the country’s precious mineral, leaves the shores of the country unnoticed, would have repercussions on the economy, hence cannot be allowed to fester.

It is estimated that, Ghana loses approximately US$2billion annually in tax revenue, due to smuggling and illegal gold operations. In 2022 alone, it is reported that, nearly 60 tonnes of gold, was smuggled out of the shores of Ghana.

The worrying development, many believe, could encourage illegal mining menace, popularly known as galamsey, if left unchecked and could deny the state the needed revenue.

Speaking at second MIIF stakeholders’ forum on Tuesday, October 15, in Accra, Mr Duker, charged the Fund to prioritize working with the ministries to combat this menace to sanitize the mining sector.

The Deputy Minister, who acknowledged the massive investments MIIF, undertook within six-years of its existence, further challenged the Fund to look at all the value addition avenues in the current mining space, and provide the necessary support for economically viable options.

He mentioned specifically, MIIF’s investment in the Ada Songhor Salt project by Electrochem Ghana Limited.

The Deputy Minister in-charge of Mining, lauded the arrangement and expressed hope that the venture will yield the best result.

“I am proud of the investments done so far, more especially the collaboration with very enviable company that is fostering the Songhor salt and I know it will be one of the best investments groups,” he said.

He further, urged the Fund to partner with the Ghana Geological Survey, to establish a mineral exploration fund and accelerate the development of the mining value chain through the development of mining catchment communities by establishing downstream value-addition industries.

The Member of Parliament (MP) for the Tarkwa Nsuaem constituency, also encouraged management of the Fund to develop the local manufacturing base to feed all the mining value chain operations through the local content and participation framework.

He tasked the Fund to help develop a more advanced framework to track production along the mining value chain to reconcile appropriate mineral rents due the State.

“I trust we would all pitch in to support these initiatives, which are meant to move us from what has been described as the colonial legacy to a more proactive approach to our developmental agenda”.

Value Addiction

Mr Duker, whose address centered mainly on value addition said, it is the key missing link countries with mineral resources like Ghana, are lacking to harness the full potentials of their minerals.

He said often, countries that benefit immensely from these minerals, are those that do not even possess these minerals, but are endowed with the necessary technologies to refine these minerals into valuable products.

“The absence of or limited access to technology in most of the minerals rich countries has meant that, the minerals are only exploited and exported to other jurisdictions which are more technologically endowed and therefore have comparative advantage in that respect. Indeed, sometimes some of these countries with the technology to add the value have virtually no mineral endowment at all”, Mr Duker explained.

He said, even though the right technologies have been lacking in the past, the current government, has put in place measures aimed at changing the status quo.

He mentioned some of these steps saying, these are channels through which Ghana is working to maximize the value chains of its minerals to the extent possible.

Among them, he indicated, are the establishment of statutory agencies like, the Ghana Integrated Aluminium Development Corporation (GIADEC) and Ghana Integrated Iron and Steel Development Corporation (GIISDEC), facilitation of the integrated development of the value chain for bauxite-alumina-aluminium and iron-and-steel, respectively.

He also highlighted the recently commissioned Royal Gold Ghana Refinery, which Ghana holds a 20percent stake, with the vision to help process gold ore produced in Ghana before exports. And that “Going forward, expanding the linkages between the sector and others, will continue to feature prominently.

A classic example, is the recent agreement with Atlantic Lithium, which aside aiming at optimizing the value chain for lithium locally, it was a requirement for by-products of the lithium mining to feed into the local ceramic industry, along with others”.

The Deputy Minister continued that, “Again, it is in pursuit of this that the, Minerals Income Investment Fund (MIIF) has been established to while functioning as the sovereign mineral wealth fund, be promoted as the mining investment partner of choice for investors who want to invest in mining in Ghana.

Such participation rights, would serve to enhance the extent to which we change the narrative from one of the leakages of the sector and the economy at large.

Finally, in addition to value addition, the government is actively pursuing the diversification of the mineral resource base, as part of optimising all possible mineral value chains.

Notably, the Ghana Geological Survey Authority, has been supported in exploring all possible minerals, especially the development-oriented industrial minerals, which are more amenable to being linked with other sectors to catalyse our development agenda”.

Speaking under the theme “Minerals values addition and value chain development-essential tools for Ghana’s development” Chief Executive Officer (CEO) of MIIF, Edward Nana Yaw Koranteng, in his welcome address, said they are using technologies to expand the royalty base of MIIF.

Mr Koranteng, disclosed that they are working to ensure that in the next 10 years, their royalty base, will grow to US$6 billion, even though in house, they are anticipating US$10 billion.

“Looking at that growth and the fact that we are expanding the royalties and we are seeing more moneys come into play, we are seeing more minerals come into play especially the critical mineral side, the graphite come into play and all that.

We also using technologies to expand our royalty base so looking at that and the fact that we have been able to grow our royalties, on these angles, we anticipate that we within 10 years-time, we should be more than US$6 billion. In house even though we have announced US$6billion, we are actually going with $10 billion”.

He outlined some of the key investments the Fund has made so far since its inception in 2018 and initiatives it is embarking on.

Source: Anchorghana.com